By Jaime Catmull, Personal Finance Expert

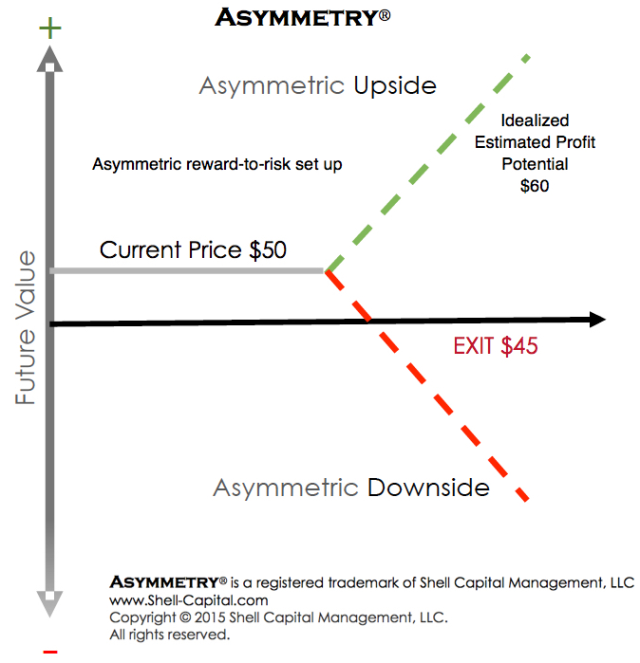

Investors, regardless of their experience level, are always in pursuit of the same goal: maximizing returns while minimizing risks. The approach to achieving this balance can vary, but one effective strategy is analyzing asymmetric risk-return. This method involves taking on risk only when there is confidence in a significantly higher return. For example, if you invest $50,000 in a property with the expectation of selling it in two years for a $250,000 profit, you are looking at a 500% return. This kind of healthy risk-return analysis can guide you toward more secure and profitable investments.

Why Asymmetric Risk-Return Is More Important Than Ever

In today’s volatile market, understanding and implementing asymmetric risk-return strategies has become essential. Measuring your potential risks against the anticipated rewards allows for more informed decision-making, ultimately leading to better investment outcomes. Here are three tips to help first-time real estate investors effectively use this strategy.

1. Understand the Market Trends

Before making any investment, it is crucial to thoroughly research and understand current market trends. This includes studying historical data, current economic conditions, and future projections. By identifying patterns and potential growth areas, you can make more informed decisions about where to invest your money. For instance, investing in an emerging neighborhood with projected development plans can offer higher returns compared to an already saturated market.

2. Evaluate the Property’s Potential

When considering a real estate investment, look beyond the immediate purchase price and evaluate the property’s long-term potential. Consider factors such as location, infrastructure development, and future demand in the area. Properties in prime locations or those that are likely to benefit from upcoming infrastructure projects often provide higher returns. Additionally, assess the property’s condition and any necessary renovations, as these can significantly impact your overall investment and return.

3. Diversify Your Investments

Diversification is a key principle in reducing risk and achieving a balanced portfolio. By spreading your investments across different types of properties and locations, you can mitigate the impact of market fluctuations. This strategy ensures that even if one investment underperforms, others can compensate, maintaining overall portfolio growth. For first-time investors, this might mean investing in a mix of residential, commercial, and rental properties in various regions.

Conclusion

Analyzing asymmetric risk-return is a valuable strategy for first-time real estate investors aiming to maximize returns while minimizing risks. By understanding market trends, evaluating the potential of each property, and diversifying investments, you can make more informed and profitable investment decisions. In today’s market, where uncertainty prevails, incorporating these tips into your investment strategy can lead to better financial outcomes and greater confidence in your investment choices.