Investors in Artis Real Estate Investment Trust (TSEUN) have faced a challenging period, with the stock price declining 27% over the past three years. This performance stands in stark contrast to the broader market, which has delivered a return of approximately 22% over the same timeframe. While the market has been generally favorable, Artis REIT’s shareholders have not been able to capitalize on these gains, leading to significant underperformance.

Analyzing the Fundamentals

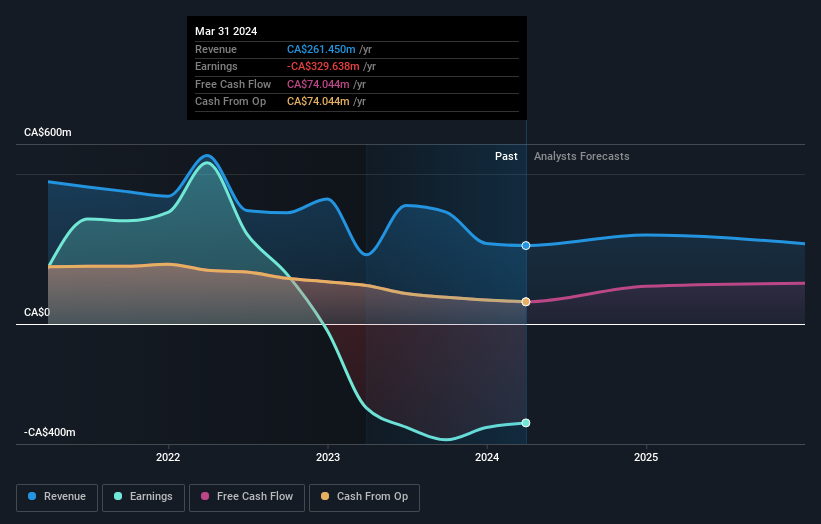

To understand this decline, it is essential to delve into the underlying fundamentals of Artis REIT. Historically, the company has demonstrated profitability. However, recent financial reports indicate a trailing twelve-month loss, raising concerns about its ability to maintain consistent profitability. This inconsistency has likely contributed to investor skepticism and the resulting share price decline.

One notable aspect is the company’s revenue trajectory. Artis REIT has experienced an annual revenue reduction of 18% over the past three years. This consistent decline in revenue signals potential long-term growth challenges, which may have spurred shareholders to divest.

Dividend Performance

Despite the declining share price, Artis REIT’s dividend appears robust. The company’s total shareholder return (TSR), which includes dividends, stands at -27% over the past three years. This TSR outperforms the mere share price return, highlighting the significance of dividend payouts. For dividend-focused investors, this aspect may provide some solace amid the overall decline.

Insider Activity and Future Outlook

Interestingly, there has been insider buying activity within the last twelve months, suggesting that some insiders believe the stock is undervalued and holds potential for future growth. This insider confidence can be a positive indicator for prospective investors.

For a more comprehensive understanding of Artis REIT’s future potential, it is crucial to examine earnings and revenue growth trends. Investors should consider analyst forecasts to gauge the company’s prospects better. Understanding market expectations can provide a clearer picture of whether the recent underperformance is a temporary setback or indicative of more profound issues.

Conclusion

While Artis Real Estate Investment Trust has faced a tough three years, marked by a significant share price decline and shrinking revenue, its strong dividend performance offers some compensation to investors. Insider buying activity also suggests potential future optimism. However, investors must closely monitor the company’s earnings and revenue trends and consider analyst projections to make informed decisions about the stock’s future prospects.

Investing in individual stocks always carries risks, and Artis REIT’s recent performance underscores the importance of thorough due diligence and continuous monitoring of financial health and market conditions. As the market evolves, so too may the fortunes of Artis REIT, and staying informed will be key to navigating this challenging investment landscape.