Maximizing Investment Returns by Minimizing Taxes: A Practical Guide

https://seasideinvestfl.com/wp-content/uploads/2024/06/67Um84msvHZx4paK9FZga9-1200-80.jpg

1200

675

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g

Investing in Real Estate Investment Trusts (REITs): A Comprehensive Guide for May 2024

https://seasideinvestfl.com/wp-content/uploads/2024/05/021d029bbaac613b0f41507b7298687c.jpeg

639

360

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g

From Modest Beginnings to Luxury Estate: The $295 Million Donahue Property

https://seasideinvestfl.com/wp-content/uploads/2024/05/DJI_20231109124026_01722_D-Edit.jpg.webp

1600

1199

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g

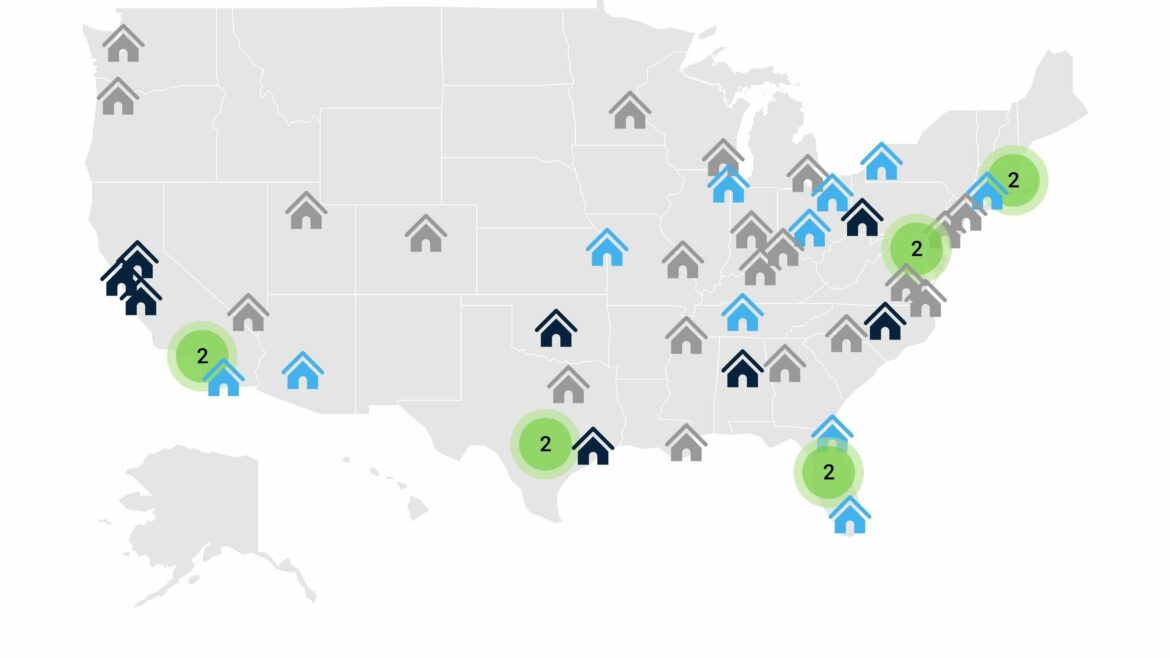

Navigating Residential REIT Investments: Stability, Growth, and Considerations”

https://seasideinvestfl.com/wp-content/uploads/2024/05/original_imageshttpsg.foolcdn.comeditorialimag.width-880_mcsGWZZ.jpg.webp

880

586

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g

Florida Dominates Top 10 U.S. Cities List for Short-Term Rental Investments

https://seasideinvestfl.com/wp-content/uploads/2024/05/AirBnB-Best-Market-Rentals-chart-1-thumb-2660x2316-34900-2-scaled.jpg

2560

2229

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g

Unlocking Real Estate Investment Potential: 3 Cities to Watch for Future Growth

https://seasideinvestfl.com/wp-content/uploads/2024/05/fort-lauderdale-2.png

2500

1330

Ines

https://secure.gravatar.com/avatar/0106806cb477f25d7f89cb87b67e4f3f622ecb464573dd53b29bfd5ba789b06c?s=96&d=mm&r=g